Safeguarding patient health information isn't just a priority - it's a legal obligation. Business Associate Agreements (BAAs) are essential for safeguarding patient health information in today's healthcare landscape. They help ensure everyone handling sensitive data is on the same page and playing by the same rules.

But keeping track of these critical agreements can feel overwhelming. That's where ContractSafe can make your life so much easier. With our easy, secure contract management solution, you can organize, track, and manage your BAAs without the headaches--so you can say compliant and focus on what really matters: delivering great care.

Table of Contents

- What Is a BAA?

- Who Needs One?

- Key Clauses

- Who Manages a BAA?

- Challenges of Managing BAAs

- How ContractSafe Can Streamline Your BAAs

- FAQ

What Is a BAA?

If you're in healthcare or work with healthcare organizations, you've probably heard the term "Business Associate Agreement" (or BAA). But what exactly is it?

A Business Associate Agreement is a type of legally binding contract mandated by the Health Insurance Portability and Accountability Act (HIPAA.)

It is formed between a covered entity — think hospitals, healthcare providers, insurance companies, or anyone else that deals with private health information — and a third party or business associate, a company that provides services to the covered entity and needs to access that private information to do its job.

The BAA outlines the permissible and required uses and disclosures of protected health information (PHI) — basically, any individually identifiable health information, whether on paper, on a computer, or even spoken aloud.

The BAA ensures the business associate will implement appropriate safeguards to prevent unauthorized access, use, or disclosure of PHI. It also makes the business associate responsible for reporting any breaches of unsecured PHI to the covered entity.

The stakes are high because non-compliance with HIPAA can lead to serious penalties, not to mention loss of trust. That's why having well-drafted, up-to-date BAAs is so important. Another vital point. BAAs are required before a business associate can access PHI. Sharing PHI without a signed BAA in place is a HIPAA violation.

Who Needs One?

If your work involves patient health information (PHI), chances are you need a BAA. These agreements ensure that everyone who touches PHI--whether directly or indirectly--follows HIPAA's rules for safeguarding sensitive data.

To break it down, let's look at who needs BAAs and why:

1. Healthcare Providers

Whether it's a sprawling medical center to a cozy doctor's office, healthcare providers must prioritize patient privacy. Hospitals, clinics, pharmacies, specialists — they all share a common thread: the need to protect patient data.

HIPAA regulations mandate that whenever a healthcare provider enlists external services that involves accessing patient data, a BAA is required.

Examples of these external services include:

- Billing and claims processing

- Transcription services

- Data analysis

- Cloud storage of electronic health records

- Email and communication platforms

A BAA acts like a safety net, making sure that everyone who handles patient data knows the rules and takes precautions. Without one, sharing PHI is like leaving the door wide open to privacy breaches--and no one wants that!

2. Health Plans

Health plans are the backbone of the healthcare system, providing coverage and managing costs for millions of people.

This includes everything from private insurance companies and HMOs to government programs like Medicare and Medicaid.

But they don't do it alone.

Health plans rely heavily on business associates to handle tasks like:

- Claims processing

- Utilization review

- Pharmacy benefit management

- Member communication

And since these tasks involve sensitive patient data, BAAs are non-negotiable.

Think of a BAA as a pact of trust between a health plan and its partners. It ensures that everyone handling patient information plays by the same rules (HIPAA's rules) and prioritizes data privacy and security.

It's a critical step in maintaining the integrity of the healthcare system and safeguarding patient confidentiality.

3. Healthcare Clearinghouses

Ever wonder how all that healthcare information flows smoothly between providers and health plans?

That's where healthcare clearinghouses step in. They act like central hubs, processing and standardizing data for things like claims processing and eligibility verification.

But with great power comes great responsibility.

Clearinghouses handle massive amounts of PHI, making them prime targets for data breaches. To mitigate this risk, they must ensure that every vendor or subcontractor they work with has a signed BAA.

This creates a chain of protection, ensuring that patient data remains secure throughout the entire information processing journey.

4. Business Associates and Their Subcontractors

When business associates engage subcontractors to help them fulfill their obligations, they need to ensure those subcontractors are equally committed to HIPAA compliance.

Some examples of these subcontractor relationships include:

- A billing company that outsources data storage to a cloud provider

- A transcription service that relies on a network of independent contractors

- A health plan that engages a marketing firm to analyze patient data

In these cases, the business associate takes on the role of a guardian, ensuring PHI remains protected throughout the entire chain of custody.

BAAs are the key to making this happen.

Extending the BAA requirement to their subcontractors and business associates creates a ripple effect of protection, safeguarding patient data at every level.

5. Other Covered Entities

The healthcare landscape is vast and varied. While healthcare providers, health plans, and clearinghouses are the most common players, other organizations also handle PHI and fall under HIPAA regulations.

Universities with medical schools or research institutions conducting clinical trials might collect health information from students, patients, or research participants. Even some government agencies and employers might handle PHI in certain contexts.

For these entities, BAAs are equally crucial.

They provide a legal framework to ensure that any business associate they work with understands their responsibilities and implements the necessary safeguards to protect sensitive data.

It's about extending the reach of HIPAA compliance and protection to all corners of the healthcare ecosystem.

Exceptions to BAA Requirements

While BAAs are generally required when covered entities share PHI with business associates, there are certain exceptions:

- Treatment purposes: When a healthcare provider discloses PHI to another provider for the purpose of treatment, a BAA is not required.

- Financial institutions: Financial institutions processing consumer payments are generally not considered business associates and don't require a BAA.

- Public health authorities: Disclosures to public health authorities like the CDC or state health departments do not require a BAA.

- Law enforcement: Disclosures required by law for law enforcement purposes are also exempt.

It's important to note that while these situations may not require a BAA, the recipients of PHI may still have obligations under HIPAA or other regulations.

Covered entities should carefully document their decision-making process when determining if a BAA is not required in a particular instance.

Key Clauses

A robust BAA includes several key clauses to ensure comprehensive protection of PHI. These clauses define the framework of the agreement and outline the responsibilities of each party:

- Parties: This section clearly identifies the covered entity and the business associate involved in the agreement.

- Definitions: It provides precise definitions of key terms like PHI, covered entity, and business associate to avoid any ambiguity or misunderstanding.

- Permitted uses and disclosures: This clause specifies the exact purposes for which the business associate is authorized to use or disclose PHI. This may include purposes such as treatment, payment, or healthcare operations.

- Safeguards: It outlines the required security measures the business associate must implement to protect PHI, including administrative, physical, and technical safeguards.

- Breach notification: This establishes the business associate's obligation to promptly notify the covered entity of any unauthorized acquisition, access, use, or disclosure of PHI (a breach).

- Termination: It specifies the conditions under which the BAA can be terminated by either party, such as a breach of the agreement or a change in the relationship between the parties.

- Indemnification: This outlines the liability of each party for breaches of the BAA, clarifying who is responsible for damages or losses resulting from a breach.

- Governing law: It identifies the jurisdiction whose laws will govern the agreement, ensuring that any legal disputes are handled in the appropriate court.

- Obligation to return or destroy PHI: This details the process for the return or destruction of PHI upon termination of the agreement. It also addresses any conditions under which PHI may be retained, such as for legal or archival purposes.

These clauses define the roles and responsibilities of each party, establish clear boundaries for the use and disclosure of PHI, and ensure that appropriate safeguards are in place to prevent unauthorized access.

Who Manages a BAA?

Managing BAAs often involves a collaborative effort among different departments within an organization.

Each department plays a crucial role in ensuring the agreement is properly implemented and maintained, including:

- Privacy officers: Privacy officers oversee the organization's HIPAA compliance program and ensure BAAs are in place with all necessary business associates. They also provide guidance and training on HIPAA regulations and best practices for protecting PHI.

- Legal counsel: Legal counsel plays a vital role in drafting and reviewing BAAs to ensure they are legally sound and comply with all applicable HIPAA regulations. They also advise on issues related to privacy compliance, breach notification, and liability.

- IT security: The IT security team implements and maintains the technical safeguards required to protect PHI. This includes measures such as access controls, encryption, and audit trails. They also work closely with business associates to ensure their systems meet security standards.

- Risk management: The risk management team assesses and mitigates the risks associated with business associates handling PHI. They identify potential vulnerabilities, develop risk mitigation strategies, and monitor compliance with BAA and HIPAA regulations.

Effective management of BAAs requires clear communication and collaboration among these departments.

Challenges of Managing BAAs

Managing BAAs can be complex and demanding, presenting several challenges:

Identifying Business Associates

One of the first hurdles is accurately identifying which vendors and partners qualify as business associates under HIPAA.

This isn't always straightforward, as some relationships might seem less directly related to healthcare operations but still involve access to PHI.

Examples of less obvious business associates include:

- A company that provides cloud storage for email backups: Even if the emails are not primarily health-related, they may contain PHI.

- A marketing firm that analyzes patient demographics and appointment history to develop targeted campaigns: Even de-identified data can potentially be re-identified, qualifying it as PHI.

- A law firm that represents a healthcare provider in a malpractice lawsuit: The law firm may need access to patient records to build a defense.

- A company that provides shredding services for medical records: Proper disposal of PHI is essential for HIPAA compliance.

It's crucial to carefully evaluate all third-party relationships and consider the nature of the services provided. If there's any possibility that a vendor or partner might come into contact with PHI, it's essential to have a BAA in place.

Negotiating Terms

Reaching a mutually agreeable BAA can involve extensive negotiation.

Covered entities must prioritize the protection of PHI, while business associates may seek to limit their liability or request modifications to security requirements. This balancing act can be tricky and often requires legal expertise to navigate.

Negotiable terms in a BAA may include:

- Specific security measures: The level of encryption, access controls, and other security measures required

- Data retention policies: How long PHI can be retained and how it must be disposed of

- Subcontracting: Whether the business associate can subcontract its services and, if so, under what conditions

- Liability limitations: The extent to which each party is liable for breaches or HIPAA violations

- Indemnification clauses: Who is responsible for covering costs associated with a breach or legal action

- Dispute resolution mechanisms: How disagreements or disputes will be handled

A clear understanding of HIPAA requirements and industry best practices is essential for effective negotiation.

Monitoring Compliance

Ensuring compliance with BAA terms and HIPAA regulations is an ongoing responsibility for covered entities and an essential part of healthcare contract management.

It's not enough to simply have a signed BAA in place; you need to actively monitor and verify that your business associates are fulfilling their obligations.

This includes:

- Regular audits: Conducting periodic audits of business associates' policies, procedures, and security measures to assess their compliance with the BAA and HIPAA requirements

- Documentation review: Reviewing business associates' documentation related to PHI handling, incident response plans, and breach notification procedures

- Data access monitoring: Implementing tools and technologies to monitor and track business associates' access to PHI, ensuring that access is limited to authorized personnel and purposes

- Incident reporting: Establishing clear communication channels for business associates to report any security incidents or breaches involving PHI

- Ongoing training: Business associates are required to provide regular HIPAA training to their employees and subcontractors who handle PHI

Effective monitoring helps identify and address potential risks before they escalate into breaches or HIPAA violations. It also demonstrates a covered entity's commitment to protecting patient data and fosters a culture of compliance among business associates.

Staying Current With Regulations

HIPAA regulations evolve over time to address new technologies, emerging threats, and changes in the healthcare landscape. And covered entities are responsible for staying informed about these updates and ensuring their BAAs remain compliant.

Failing to stay up-to-date can lead to HIPAA violations and penalties, including significant financial fines and corrective action plans.

Outdated BAAs may have inadequate security provisions, increasing the risk of data breaches and harming the covered entity's reputation.

In case of a breach or HIPAA violation, the covered entity may also face lawsuits and legal action.

To maintain compliance and mitigate risks, covered entities should pay close attention to these key areas and updates:

- HITECH Act: This act expanded HIPAA's scope by increasing enforcement and breach notification rules and extending HIPAA requirements to business associates, introducing stricter penalties for violations.

- Omnibus Rule: This rule strengthened patient privacy protections, modified breach notification requirements, and clarified the liability of business associates.

- HIPAA Privacy Rule: This rule set national standards for protecting individuals' medical records and other personal health information, including patient rights to access and control their health information, restrictions on the use and disclosure of PHI, and administrative requirements for covered entities.

- HIPAA Security Rule: This rule established national standards for protecting electronic protected health information (ePHI), outlining administrative, physical, and technical safeguards that covered entities must implement to ensure the confidentiality, integrity, and availability of ePHI.

- Breach Notification Rule: This rule requires covered entities and business associates to notify individuals, the Department of Health and Human Services (HHS), and in some cases, the media, of a breach of unsecured PHI.

Proactive attention to regulatory developments, participation in industry conferences, and ongoing education are essential for maintaining compliance and mitigating legal and financial risks.

Handling Breaches

Despite your best efforts, breaches of unsecured PHI can still occur.

Responding effectively to breaches requires swift action, a thorough investigation, and appropriate notification of affected individuals.

The consequences can be severe if a breach is handled poorly.

A delayed or inadequate response can exacerbate the impact of a breach, leading to identity theft, financial loss, or even physical harm in some cases.

Failure to comply with breach notification requirements can result in increased fines and penalties from regulatory agencies. Dropping the ball here can also damage the covered entity's reputation and erode public trust.

It’s important to have a clear incident response plan in place, including reporting, investigation, mitigation, and notification procedures, to minimize the harm caused by a breach.

Managing Multiple BAAs

Many covered entities work with numerous business associates, each requiring a BAA.

Tracking these agreements, ensuring consistency across terms, and efficiently updating them when regulations change can be a significant administrative burden.

This can involve challenges like:

- Maintaining version control

- Managing renewals

- Ensuring consistency across agreements

- Keeping BAAs securely stored and accessible to authorized personnel

Implementing efficient systems for managing and updating BAAs, such as healthcare contract management software, is crucial for maintaining compliance and minimizing risk.

How ContractSafe Can Streamline Your BAAs

Managing Business Associate Agreements is no small task. Between juggling dozens (or even hundreds) of agreements, staying compliant with ever-changing HIPAA regulations, and ensuring nothing slips through the cracks, it's easy to feel overwhelmed. But it doesn't have to be that way.

ContractSafe offers a powerful solution to simplify and centralize the management of your BAAs, freeing you from tedious administrative burdens and empowering you to focus on what matters most: protecting patient data.

Here's how ContractSafe can revolutionize your BAA management:

- Centralized repository: With ContractSafe, you can store all your BAAs in a secure, cloud-based repository. This means authorized personnel can access any agreement from anywhere, anytime, with just a few clicks. No more frantic searching or wasted time — everything is neatly organized and readily available. Imagine having a digital library of all your BAAs with robust search and filtering capabilities.

- Automated workflows: Never miss a renewal deadline or a critical review date again. ContractSafe's automated workflows allow you to set up reminders for key dates and milestones, ensuring timely action and preventing costly oversights. You can even configure automated alerts for breach notifications, enabling a swift response to potential HIPAA violations. It's like having a dedicated assistant who keeps track of all your BAA obligations and proactively reminds you of upcoming tasks.

- Version control: Tracking different versions of BAAs can be a nightmare. ContractSafe's version control feature allows you to track every change and update to your agreements, ensuring everyone is on the same page and working with the most current version. If needed, you can easily compare versions, identify modifications, and revert to previous versions. This eliminates confusion, streamlines collaboration, and ensures a clear audit trail.

- Advanced search: Need to quickly find a specific clause or piece of information within a BAA? ContractSafe's advanced search capabilities make it a breeze. You can search across all your BAAs by keyword, clause, date, party, or any other relevant criteria. No more sifting through pages of legalese — find what you need in seconds.

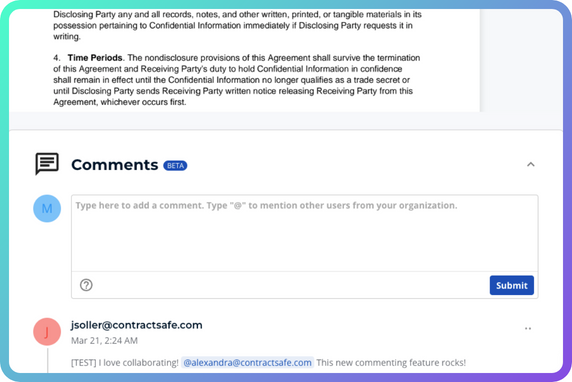

- Collaboration tools: BAAs often require input and review from multiple stakeholders, including privacy officers, legal counsel, and IT security personnel. ContractSafe facilitates seamless collaboration with built-in tools for sharing, commenting, and redlining agreements. This streamlined communication ensures everyone is on the same page and accelerates the review and approval process.

Leveraging ContractSafe will help you reduce the administrative burden of managing BAAs and other types of healthcare contracts, enhance compliance efforts, and mitigate the risks associated with PHI handling.

It's time to say goodbye to manual processes and hello to a streamlined, efficient, and secure approach to BAA management.

FAQ

Still have questions? This FAQ will help you understand how to protect and stay HIPAA compliant patient health information.

What Is a Business Associate Agreement?

A business associate agreement is a legally binding contract mandated by the Health Insurance Portability and Accountability Act. It establishes a relationship between a covered entity (healthcare providers, health plans, clearinghouses) and a business associate, which is any third-party entity that handles protected health information on behalf of the covered entity.

Who Needs a BAA?

Any covered entity that engages a business associate to perform activities or services involving PHI must have a BAA in place. This includes healthcare providers, health plans, healthcare clearinghouses, and any other entities handling PHI. Business associates who further subcontract their services to other entities also need to ensure those subcontractors have BAAs in place.

What’s the Difference Between a BAA and a NDA?

While both BAAs and non-disclosure agreements (NDAs) protect sensitive information, they serve different purposes. A BAA specifically addresses the handling of PHI under HIPAA regulations. It outlines specific safeguards and breach notification requirements that go beyond the general confidentiality provisions of an NDA. An NDA, on the other hand, is a broader agreement that can protect any type of confidential information, not just PHI.

How Often Should a BAA Be Signed?

A BAA should be signed before any PHI is shared with a business associate. The BAA should also be reviewed and updated periodically to ensure it remains compliant with any changes in HIPAA regulations or the nature of the services provided. While there's no specific timeframe mandated by HIPAA, it's generally recommended to review and update BAAs at least annually or whenever there's a significant change in the relationship or services provided.