M&A due diligence is thoroughly investigating a target company's financial, legal, and operational status before finalizing an acquisition.

It involves reviewing financial records, contracts, legal documents, and other relevant information to assess the company's health, identify potential risks, and confirm the accuracy of the information provided by the seller.

It's a big task but crucial for making informed decisions and protecting your interests. This is where effective contract management becomes your lifeline.

In this post, we’ll discuss the M&A due diligence process and how you can use a contract management solution to bring order to your document chaos.

Table of Contents

- Objectives of M&A Due Diligence

- How To Perform Due Diligence

- How Contract Management Software Can Streamline Your Due Diligence Process

- Get Started With ContractSafe Today

Objectives of M&A Due Diligence

Before diving into the "how-to" of performing due diligence, it's essential to understand its core objectives.

The process lets the buyer thoroughly evaluate the target company's assets, liabilities, and overall business operations.

The primary objective is to identify potential risks and validate the seller's financial, legal, and operational information.

Thoroughly investigating these areas provides a thorough understanding of the target company, allowing the buyer to decide whether to proceed with the acquisition.

It empowers buyers to negotiate confidently, structure the deal effectively, and, ultimately, increase the likelihood of a successful and profitable acquisition.

How To Perform Due Diligence

Now that we understand the 'why,' let's delve into the 'how' of conducting effective due diligence.

Phase 1: Planning and Preparation

Just as a successful expedition requires meticulous planning, so too does effective due diligence.

First and foremost, you need to assemble your team of experts.

Due diligence is a multidisciplinary endeavor requiring specialists in various fields, including legal, financial, operational, HR, tax, IT, marketing, and sales. Each member brings their unique expertise to the table, ensuring a comprehensive assessment of the target company from all angles.

Once your team is in place, clearly defining roles and responsibilities is crucial. This avoids confusion and ensures everyone is on the same page, working towards a common goal.

A well-defined timeline with realistic milestones and deadlines keeps the process on track and helps avoid unnecessary delays.

Resource allocation is another critical aspect of planning.

Determine the budget and resources needed to conduct a thorough due diligence process. This includes allocating sufficient time, personnel, and financial resources to ensure a comprehensive investigation.

Before diving into the data, defining the scope and objectives of your due diligence is essential.

- What are the key questions you need to answer?

- What are the critical risks you need to assess?

- What are the specific areas you need to focus on?

Clearly defining your objectives will guide your investigation and ensure you gather the most relevant information.

Identifying potential risks and areas of focus upfront is also crucial. This allows you to prioritize your investigation and allocate resources effectively.

- What are the potential red flags that could derail the deal?

- What are the critical areas that require in-depth scrutiny?

- Are there any active agreements you need to be aware of?

Finally, a comprehensive checklist is invaluable for ensuring that all necessary areas are covered during the due diligence process. This helps prevent overlooking critical information or tasks and ensures a thorough and systematic investigation.

Of course, before any sensitive information is exchanged, it's essential that both parties sign a non-disclosure agreement. This agreement protects the confidentiality of the data shared during the process and ensures that both sides can proceed with open communication and trust.

Phase 2: Information Gathering

With your plan in place and your team assembled, it's time to roll up your sleeves and gather information about the target company.

This phase involves collecting and organizing relevant data from various sources and building a comprehensive picture of the company's operations, financials, and legal standing.

This information-gathering process might involve:

- Document collection: Gathering all relevant documents, including financial statements, contracts, legal documents, employee records, environmental permits, and any other relevant information that can shed light on the target company's operations and condition.

- Site visits: Conducting site visits to the target company's facilities to observe operations firsthand and assess the condition of assets. This allows you to get a feel for the company's culture, see how things work on the ground, and potentially identify any red flags that might not be apparent from the documents alone.

- Management interviews: These involve interviewing key personnel to gain insights into the company's operations, strategy, and culture. These interviews can provide valuable qualitative information and help you understand the company's management team, vision, and plans for the future.

Throughout this process, it's important to remain vigilant and observant, looking for any inconsistencies or red flags that might warrant further investigation. Don't hesitate to request additional information or clarification on any areas of concern.

Phase 3: Analysis and Evaluation

Now that you've gathered a wealth of information, it's time to put on your analytical hat and start digging deeper.

This phase involves critically analyzing the gathered information to identify potential risks and opportunities, assess the target company's true value, and determine whether it aligns with your acquisition objectives.

This analysis might include:

- Financial analysis: Analyzing financial statements, cash flow projections, the value of contracts, and debt obligations to assess the target's financial health and identify potential red flags

- Legal review: Reviewing contracts, legal documents, and compliance records to identify potential legal risks and liabilities

- Human resources assessment: Assessing human resources, including reviewing employee contracts and benefits and assessing potential retention risks, is essential for understanding the workforce you're acquiring and planning for a smooth transition

- Intellectual property verification: Confirming the ownership and validity of intellectual property rights is crucial, especially in knowledge-based industries

- Operational assessment: Evaluating the target's business processes, supply chain, and technology infrastructure to assess efficiency and identify potential areas for improvement

In addition to these core areas, due diligence often involves verifying the ownership and validity of intellectual property rights, assessing human resources, reviewing employee contracts and benefits, and identifying potential retention risks.

This phase aims to develop a comprehensive understanding of the target company's strengths, weaknesses, opportunities, and threats.

This will help you decide whether to proceed with the acquisition and, if so, how to structure the deal to mitigate risks and maximize value.

Phase 4: Reporting and Decision-Making

With your analysis complete, it's time to synthesize your findings and decide.

This phase involves preparing a comprehensive due diligence report summarizing the key findings, risks, and opportunities identified during the process.

The report should provide a clear and concise overview of the target company, highlighting its strengths and weaknesses and outlining any potential risks or liabilities that could impact the acquisition.

It should also assess the overall risks and benefits of the transaction, considering the financial, legal, operational, and human resources aspects.

Based on this report, you can then decide whether to proceed with the acquisition, renegotiate the terms, or walk away from the deal.

Phase 5: Negotiation and Deal Structure

If you proceed with the acquisition, the next step is negotiating the final deal terms.

This involves leveraging the due diligence findings to address any concerns or risks identified during the process and to structure the deal to protect your interests.

Based on the due diligence findings, it might involve renegotiating the purchase price, closing conditions, or other terms.

It's also important to ensure that the final agreement adequately addresses any potential liabilities or risks identified during the due diligence process.

Red Flags to Watch For During Due Diligence

Throughout the due diligence process, it's important to be vigilant and watch out for any red flags that could signal potential problems.

Red flags could indicate hidden liabilities, undisclosed risks, or other issues that could impact the acquisition's value.

Some common red flags to watch out for include:

- Financial irregularities: Unexplained accounting discrepancies, inconsistent financial reporting, or questionable financial practices

- Legal disputes and pending litigation: Ongoing lawsuits, unresolved legal issues, or potential regulatory violations

- Operational inefficiencies and risks: Outdated technology, inefficient processes, or significant operational challenges

If you encounter any red flags during the due diligence process, it's crucial to investigate them thoroughly and assess their potential impact on the acquisition.

How Contract Management Software Can Streamline Your Due Diligence Process

Due diligence involves sifting through mountains of contracts. But contract management software can help.

1. Centralized Contract Repository

No more frantic searches through filing cabinets or shared drives.

Contract management software stores all your agreements and related documents in a centralized repository, accessible to your due diligence team anytime, anywhere.

This ensures that everyone has access to the latest versions of the documents and reduces the risk of missing critical information.

2. Streamlining Document Review and Analysis

Manually reviewing contracts can be a massive undertaking

But with contract management software, you can automate many of these tasks, significantly speeding up the review process and improving accuracy.

- Automated search and filtering: Quickly find the contracts you need based on keywords, dates, parties involved, or other criteria.

- AI-powered categorization and tagging: Organize contracts by type, enabling faster identification of relevant agreements for the M&A process, such as those with non-compete or change of control provisions.

These features help your team quickly locate and analyze critical clauses, assess potential risks, and extract key information, making the due diligence process more efficient and effective.

3. Facilitating Collaboration and Communication

Contract management software provides a platform for seamless communication and collaboration among team members, ensuring everyone is on the same page and working towards a common goal.

- Secure document sharing and version control: Share contracts securely with team members and external parties, track changes, and maintain a clear audit trail of all activity.

- Date and obligation tracking: Assign tasks to team members, track progress, and ensure everyone meets deadlines.

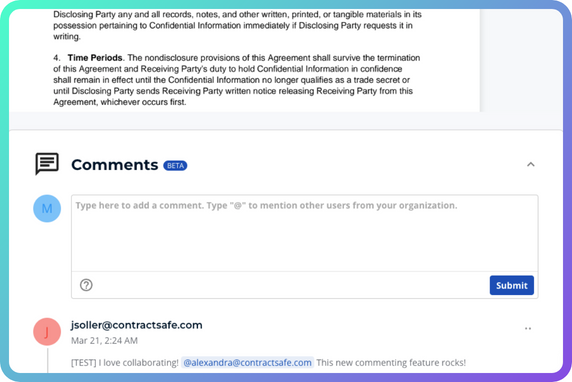

- Commenting and collaboration tools Allow different teams to collaborate within the system on edits and discussions, streamlining communication and ensuring everyone is aligned.

These features foster a collaborative environment, improve communication, and ensure everyone has access to the latest information, facilitating a smoother and more efficient due diligence process.

4. Mitigating Risk and Compliance

Ensuring compliance with legal and regulatory requirements is critical to due diligence.

Contract management software can help you identify and mitigate potential risks, ensuring that your acquisition complies with all applicable laws and regulations.

- Identify contractual risks and obligations: Quickly identify potential risks and obligations hidden within contracts, such as non-compete clauses, indemnification provisions, or regulatory compliance requirements.

- Monitor compliance with legal and regulatory requirements: Track key dates and deadlines, receive alerts for upcoming renewals or expirations, and ensure that all contracts are up-to-date and compliant.

Automating compliance checks and providing a clear overview of contractual obligations will help you mitigate risks and ensure a smooth and compliant acquisition process.

5. Staying on Top of Contractual Obligations Post-Merger

The due diligence process doesn't end with the acquisition.

Contract management software can help you monitor contractual obligations even after the deal is closed, ensuring a smooth transition and ongoing compliance.

- Track deadlines and renewal dates: Stay informed about upcoming deadlines, expirations, and renewals, ensuring you don’t overlook any critical agreements.

- Ensure compliance with contractual terms: Monitor ongoing compliance with contractual terms and conditions, mitigating risks and ensuring a smooth and successful integration.

Contract management software provides a centralized platform for managing contracts and tracking obligations, helping you maintain control and ensure compliance throughout the entire M&A lifecycle.

6. Secure Access Control

Protecting sensitive information is paramount in any M&A transaction.

Contract management software provides robust security features to ensure that your contracts and data are safe and secure.

- User roles and permissions: Control access to sensitive information by assigning different roles and permissions to users. This ensures that only authorized personnel can access confidential data.

- Data encryption and security protocols: Encryption and other security protocols safeguard your data from unauthorized access and cyber threats.

Contract management software provides a secure environment for managing contracts, helping you protect sensitive information and maintain confidentiality throughout the due diligence process.

Get Started with ContractSafe Today

Don't let contract chaos derail your M&A due diligence.

Take control of your contracts and streamline your process with ContractSafe.

Our secure, centralized platform empowers your team to easily navigate the complexities of due diligence, minimizing risks and maximizing efficiency.

Ready to experience the ContractSafe advantage? Explore our features and discover how we can help you optimize your M&A process.