What is Contract Risk Management?

Contract risk management is the process by which organizations identify and assess risks and manage contracts to limit liability or other harm to the company. The objective is to limit the company’s exposure to loss and ultimately to protect the organization’s assets.

All companies face risk daily – it’s a normal and acceptable part of business. The issue is to eliminate unnecessary risks while recognizing remaining risks and managing them appropriately. An effective contract management process is instrumental in this regard. Below are a few examples of beneficial contract risk management actions a company should consider:

- Put everything in writing – this helps avoid disputes and litigation over alleged verbal promises.

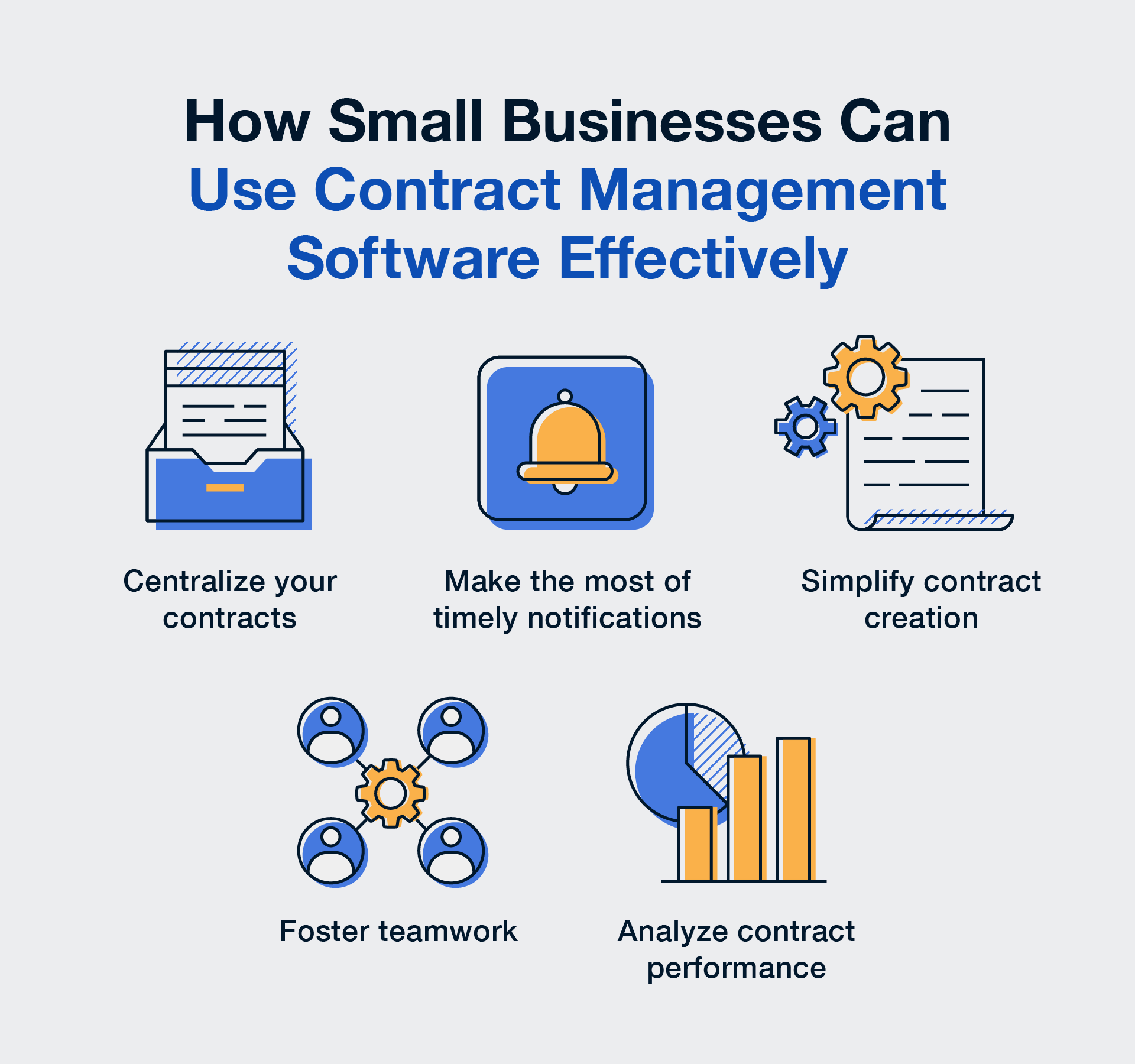

- Use a centralized contract repository – by storing all contracts in a centralized repository, the risk of misplacing or losing paper contracts is eliminated.

- Identify at-risk assets of the company and negotiate contracts to protect them. To avoid future litigation, make sure the resulting contracts are well-drafted and clear. Consider the use of liability-shifting clauses and provisions such as warranties, waivers, and limitations of liability.

- Track compliance – companies lose revenue and incur unnecessary expenses simply by failing to track compliance with contractual requirements, or sometimes by actually losing track of the fact that an issue is covered under a contract.

The risks described in these examples, and lots of others, can be managed with the many contract management features provided by ContractSafe contract management software.

Get Started with ContractSafe Today